By using this website, you agree to our Terms of Use (click here)

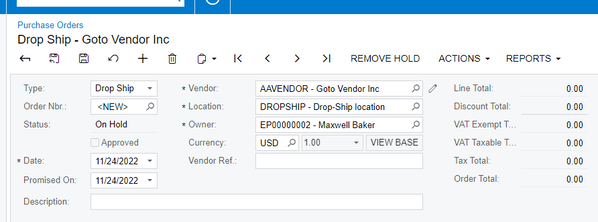

I encounter the tax issues for the drop shipping in Acumatica

Apparently, Acumatica sent the vendor address from our drop shipping order to Avalara as originate to calculate the tax which create so much of the confusing to our customer of how do we come up the tax calculation. For example,

- We have the branch and warehouse in both of the State of AZ and CA.

- So both of AZ and CA will be the collecting states (nexus) in our Avalara Console.

- Customer in AZ made a purchase from our AZ branch

- We ask our vendor in CA to drop ship the order to our AZ customer.

- And on Avalara admin console, for each drop ship LINE item, it will show the originated address is CA and the destination is AZ. But the total tax charges is only showing up for partial which is for AZ State and AZ City without AZ County..Now if we don't create the drop ship PO in Acumatica and just ship as stock from our AZ warehouse and branch, it will charge the full AZ tax.

Very strange behavior. And I have been in numerous support calls with Avalara and they said they cannot control of what Acumatica send their originated address or destination address on each line items. And when I talk to Acumatica support, they said I need to request a custom change work order if we want Acumatica to always send the originate address from our warehouse location of by passing the drop ship vendor address...

Hmmm, sounds like a headache.

Especially this part: If Acumatica is sending your Vendor's address (which is in California) and that address is being used to calculate sales tax, then why is it calculated Arizona sales tax on a California address?

Experiencing the same issue. did you manage to get a workaround for this?